Our Growth Opportunities

Atlantica is well positioned to benefit from the expected transition towards a more sustainable power generation mix in our markets. We intend to take advantage of, and leverage our growth strategy on, favorable trends in the clean power generation and the global focus on the reduction of carbon emissions.

We intend to grow our business maintaining renewable energy as our main segment with a primary focus on North America and Europe, as well as expect to acquire assets from third parties leveraging the local presence and network we have in geographies and sectors in which we operate.

Our plan for executing this strategy includes the following key components:

- Development: we invest in the development and construction of new assets, in some cases on our own and in other cases through partnerships with developers. We currently have a 2.2 GW renewable energy pipeline, which is coupled with ~6.0 GWh of storage capacity with a core-focus on the U.S.

- Optimization of existing portfolio: we believe we can achieve organic growth through revenue escalation factors at many of our assets, operational improvements, and financial optimization of our existing project debt.

- Expansion and repowering: we have opportunities of repowering and hybridization with other technologies of some of the renewable energy facilities, as well as expansion opportunities of our transmission lines.

- Third party Acquisitions: we expect to acquire assets from third parties leveraging the local presence and network we have in geographies and sectors in which we operate.

Pipeline Overview

Our project identification process is supported by a rigorous analysis and deeply rooted industry knowledge experience.

By focusing our development activities on locations where we already have assets in operation and by working in many cases with partners, we have been able to maintain our development cost at what we believe are low levels.

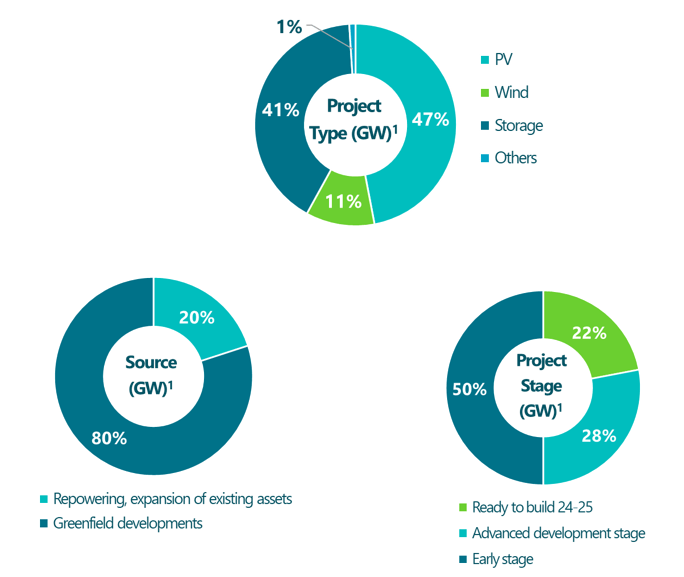

We currently have a pipeline of assets under development of approximately 2.2 GW of renewable energy and 6.0 GWh of storage. Approximately 47% of the projects are in PV, 41% in storage and 11% in wind, while 22% of the projects are expected to reach ready to build (“Rtb”) in 2024 or 2025, 28% are in an advanced development stage and 50% are in early stage.

| Pipeline of Assets Under Development1 | ||

| Renewable Energy (GW) | Storage (GWh) | |

| North America | 1.2 | 4.3 |

| Europe | 0.4 | 1.6 |

| South America | 0.6 | 0.1 |

| Total | 2.2 | 6.0 |